E-way bills are directly integrated with the e-invoicing system. This number can be used by the supplier, recipient, and transporter to track the movement of goods. Whenever there is an e-way bill requirement and you generate one, you'll be assigned a unique E-way Bill Number (EBN). This document is required in order to move goods between states in India. 50,000, there will be an e-way bill requirement. If you're transporting goods worth more than Rs. The link between an E-Invoice and E Way bills? If you're still using paper invoices, now is the time to make the switch to e-invoicing and reap its benefits.įor better clarity read about GST filing. With the government mandating all businesses to generate invoices electronically, it's only a matter of time before everyone makes the switch. The costs associated with setting up and maintaining an e-invoicing system can be quite high, especially for small businesses.ĭespite these challenges, e-invoicing is still considered to be one of the best methods for tax compliance in India. One of the main reasons why businesses haven't made the switch to e-invoicing is that it can be quite expensive.

For businesses that are already struggling with GST compliance, having to generate invoices electronically can be an additional burden. One of the biggest complaints about e-invoicing is that it's a lengthy and complicated process. This is often because they don't have access to technology or they lack trained personnel who can operate the system. As a result, many businesses are yet to realize the importance of making the switch to e invoicing under GST.Īnother challenge is that many businesses don't have the resources or manpower to generate invoices electronically. With the rollout of GST e invoice, there has been a lot of confusion and chaos surrounding tax compliance. Here are some of the major challenges of e-invoicing under GST and with e invoice e way bill requirements in India:Īs mentioned earlier, one of the biggest challenges is that many businesses are still unaware of e-invoicing and its benefits. This is often because they are unaware of the benefits of e-invoicing or they haven't had the time to familiarize themselves with the process. Major Challenges of E-Invoicing Under GSTĭespite the fact that e invoicing under GST has been around for a while now, there are still many businesses that are yet to make the switch. In short, the e Invoicing under GST system is a valuable tool for businesses operating in India. The system also allows businesses to track their invoices and ensure that they are being filed correctly. The E-Invoicing system is designed to streamline this process and make it easier for businesses to comply with GST regulations. Customers then use this GST number to file their taxes.

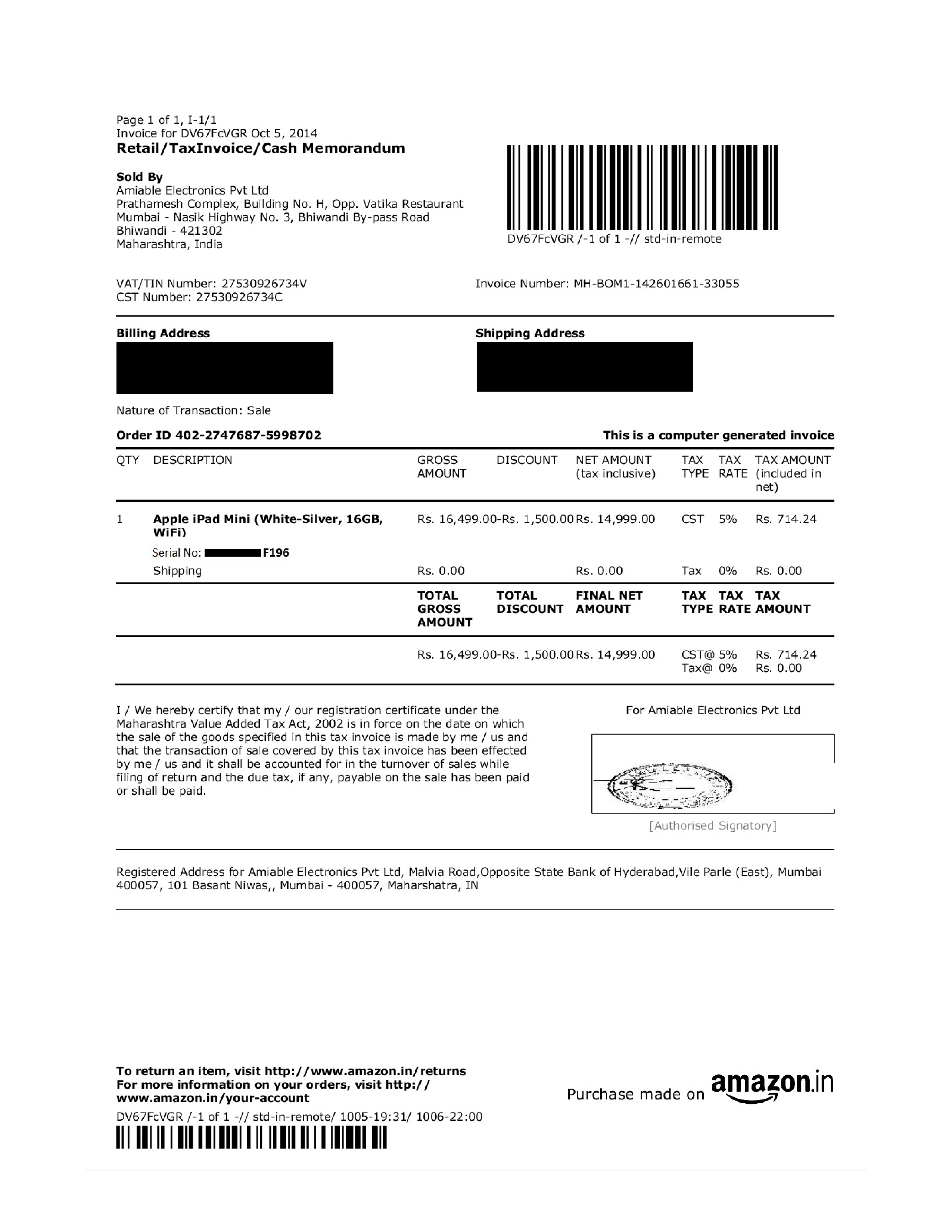

Businesses issue an invoice to their customers, which includes a GST number. The current e invoice system in India is quite simple. With an e voice e way bill, you can rest assured that your taxes are prompt and regular.

So next time you're feeling frustrated with the tedious process of filing your taxes and wondering what is GST e invoice, just remember: it could be worse. This has not only made it easier for businesses to comply with the law but also made it much harder for unscrupulous characters to get away with tax evasion Thanks to e invoicing under GST, taxpayers can now track their invoices in real-time, report all GST filings in one go, and easily claim input tax credits. One of the most effective tools in the fight against tax fraud is e-invoicing.

#AMAZON INVOICE UPLOAD CRACK#

But in recent years, India has been taking steps to crack down on this insidious crime. Tax fraud has been a problem since the dawn of taxation itself. Now that you are familiar with what is GST e invoice, let's move ahead with the invoicing under GST applicability. E invoicing under GST will help to improve the efficiency of the invoicing process and help businesses minimize errors.

#AMAZON INVOICE UPLOAD CODE#

The QR code will contain all of the necessary information about the invoice, including the GST number, value, and date.

#AMAZON INVOICE UPLOAD SOFTWARE#

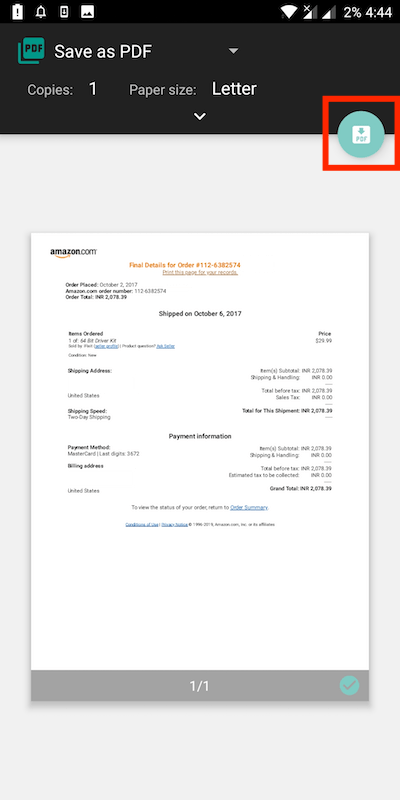

This software will then create a unique QR code for each invoice, which can be scanned by the recipient. Under this system, businesses will be required to generate invoices using approved e-invoicing software. This system is designed to streamline the invoicing process and help businesses save time and resources. What is e invoicing under GST, and why is it so important and e invoicing under GST applicability for businesses? Stay tuned to find out!Į Invoicing in GST is an online system for businesses to generate and send invoices electronically. Is your business ready for GST? If you're not sure what that means, don't worry – we're here to help! In this post, we'll give you a primer on e invoicing under GST.

0 kommentar(er)

0 kommentar(er)